By Carlos Blanco, Pigs On The Roof

Often people have the unfounded notion that banks provide financing to start-ups and early stage businesses. The reality is that nothing could be further from the truth.

Often people have the unfounded notion that banks provide financing to start-ups and early stage businesses. The reality is that nothing could be further from the truth.

Banks are not in the business of losing money. So, by definition, they only lend money to individuals and businesses who they believe have a very good chance of repaying the load. Worst case, a bank may fund a marginal borrower based on collateral the bank can collect should the loan default.

So what is a start-up to do? How about a business with an unproven track record? How do these people get the funding they need to get the idea off the ground or fuel early growth?

Before exploring funding types and options, the first thing to look for is a mirror. Yes, a mirror. Anyone seeking financing should look at themselves in that mirror and honestly answer these key questions:

- Am I a good founder? Do I have a history of success? Do I have a great team?

- Is my idea/business simple to understand?

- Am I in a market that’s growing or one where I can take share?

- Do I have a first mover or competitive advantage, intellectual property?

- Can I show early traction or at least a real proof of concept?

- Am I willing to give-up a realistic portion of my business for the money I need?

- Am I ready to detail my business in the form of a plan?

Assuming the honest answer to each of these questions is “yes”, you can move forward to exploring funding types and options.

Funding Types

- Using your own assets or cash to fund the venture, at least at the start.

- Money to be repaid according to the agreed upon terms.

- Giving up a portion of the company/idea in return for capital, with no guarantee that the company/idea will succeed.

- Combination of the above

Generally speaking, for a typical start-up, debt financing is limited to credit cards or loans collateralized by some other, usually personal, assets. And the type of funding that is appropriate depends on the stage of your business.

Seed. The initial funds required to build a prototype and/or prove the business concept. It’s the riskiest investment for yourself and a possible investor. It’s also the hardest type of funding to attract.

Start-up. With the product built/business concept proven, this is funding to initiate business operations and secure the initial customer base. The focus is on market entry and securing as many customers as possible.

Expansion. With a significant customer base and the business operational, this funding is for expansion. The focus is on professionally managing and scaling the business so as to grow revenues as quickly as possible.

Depending on the business/product and “cash burn”, the start-up and expansion stages could involve multiple funding rounds—i.e., early stage, second-stage, etc.

Funding Options

- Your own money to “bootstrap” the concept/business until you have other options.

- Many popular sites are available for this purpose.

- Friends and Family. Anyone close to you with money that believes in your business concept and you.

- Accredited Investor. As defined by the Securities and Exchange Commission (Regulation D, Rule 501):

- Individual whose net worth, or joint net worth with that individual’s spouse, exceeds $1,000,000.

- Individual who had an income in excess of $200,000 in each of the two most recent years or joint income with that individual’s spouse in excess of $300,000 in each of those years and has a reasonable expectation of reaching the same income level in the current year.

- Individual Angel and/or Fund. Professional, individual investors or funds that pool professional investors’ money in order to invest in businesses.

- Venture Capital. Funds that come in many sizes and can invest across the spectrum of stages: seed, start-up, expansion, mezzanine and IPO. Typically invest at the exclusion of previous investors and can take a controlling position in your business over time.

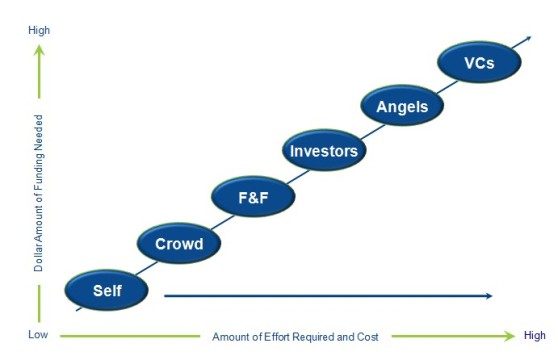

Each option has its advantages and disadvantages. For example, self-funding is the easiest to secure (you can’t turn yourself down), but it is limited by the amount of cash available to you.

At the opposite side of the spectrum, you have venture capital funding, which could potentially mean a lot of money. However, VC funding takes an enormous amount of work and the chances of success are slim to none. Think of this option as winning the lottery and then potentially paying a high cost for that privilege.

At the opposite side of the spectrum, you have venture capital funding, which could potentially mean a lot of money. However, VC funding takes an enormous amount of work and the chances of success are slim to none. Think of this option as winning the lottery and then potentially paying a high cost for that privilege.

Each funding source has its own nuances and serves a particular purpose. The type of funding you pursue should tie to your cash needs and the size of the idea. The bigger the market potential, scope of idea and possible return, the more venture capital makes sense. Think Facebook, for instance.

For a small, local business, say a bakery or barbershop, self-funding and cash from family and friends makes the most sense. Of course, the area in the middle is a bit more complicated, and this is where accredited investors and angels play a key role.

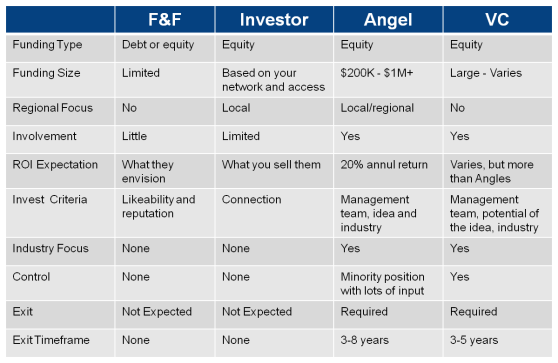

The following table, at a macro level, compares the various options.

Take it from someone who has raised private equity more than once, the cost of raising capital is very significant, both in terms of time and money—it’s realistic to take more than a year working at securing funding, without any guarantee of success. And if your venture is successful, it will likely be the most expensive financing you ever secure.